Sample Financial Goal Plan

What does a financial goal plan look like?

Please click through the slides below to see the pages of a sample financial goal plan. Ask yourself the questions on each slide. If you’re unsure or don’t have answers, Embolden Financial Planning LLC can help you find them. If you have questions or are ready for your own financial goal plan, let’s talk.

-

![Snapshot Summary Financial Goal Plan]()

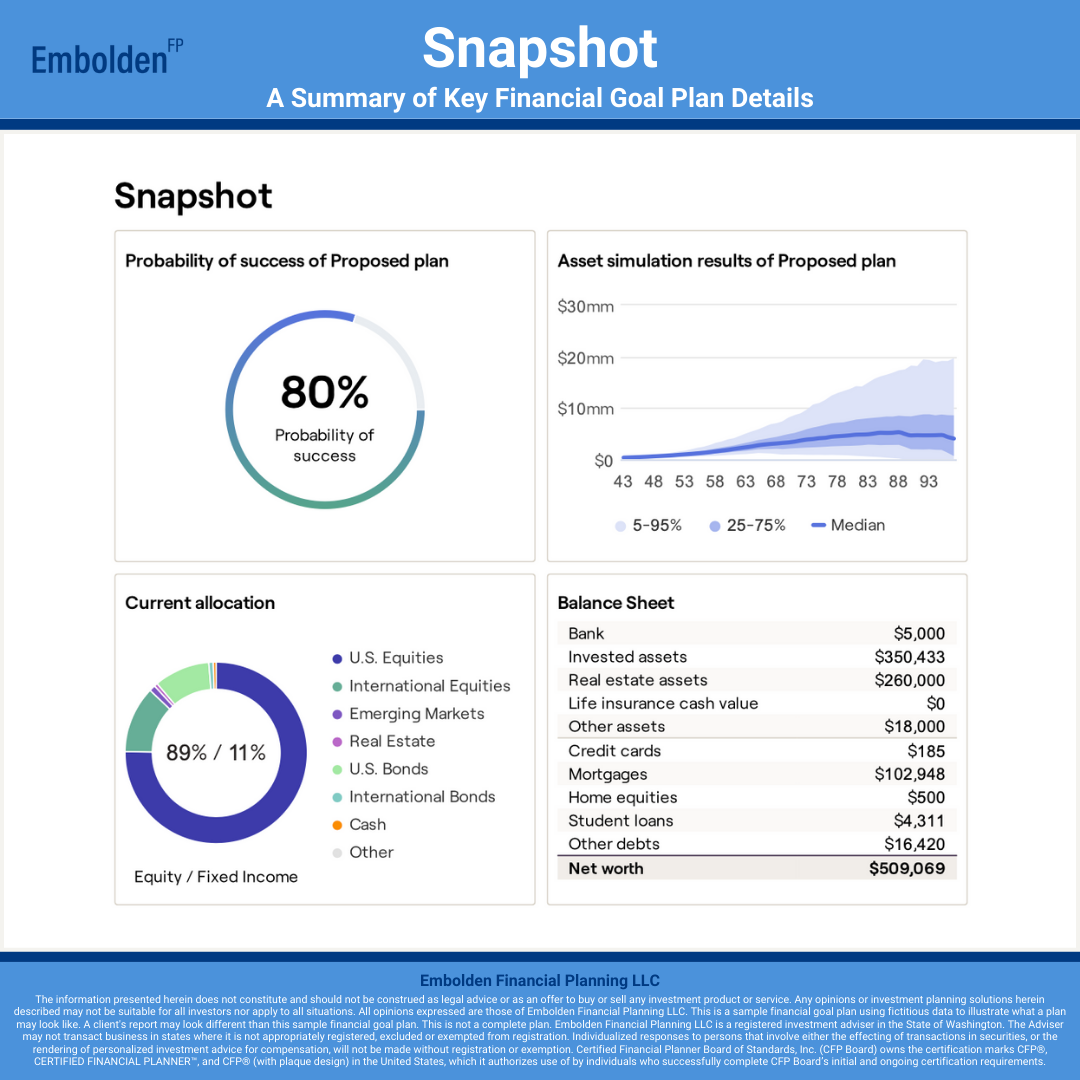

Meet Homer and Marge. This is their Financial Goal Plan.

One of the first pages in their plan is the Snapshot page. The Snapshot is a one- or two page summary of many of the key elements in their financial goal plan. Most of the detailed information follows in the pages after the Snapshot, but sometimes it's nice to just see a simple summary.

-

![Snapshot Probability of Success Financial Goal Plan]()

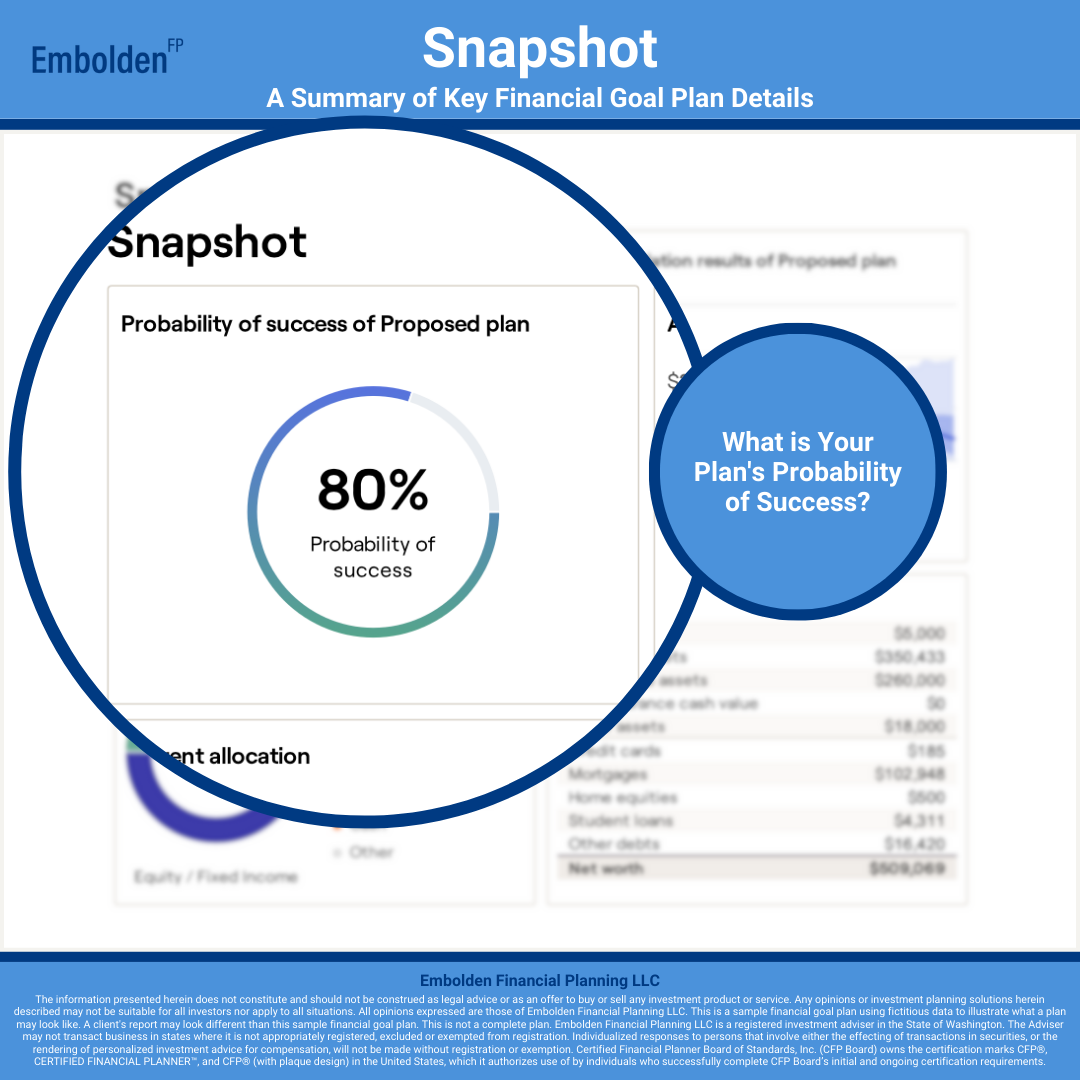

Homer and Marge's Financial Goal Plan has an 80% probability of success.

After the Discovery, Get Organized, and Explore Possibilities Meetings with Embolden Financial Planning LLC, they have a Financial Goal plan and are on track for all of their goals before and after retirement. There is an 80% Probability of success that they will not run out of money in any one year of their plan.

-

![Snapshot Asset Projection Financial Goal Plan]()

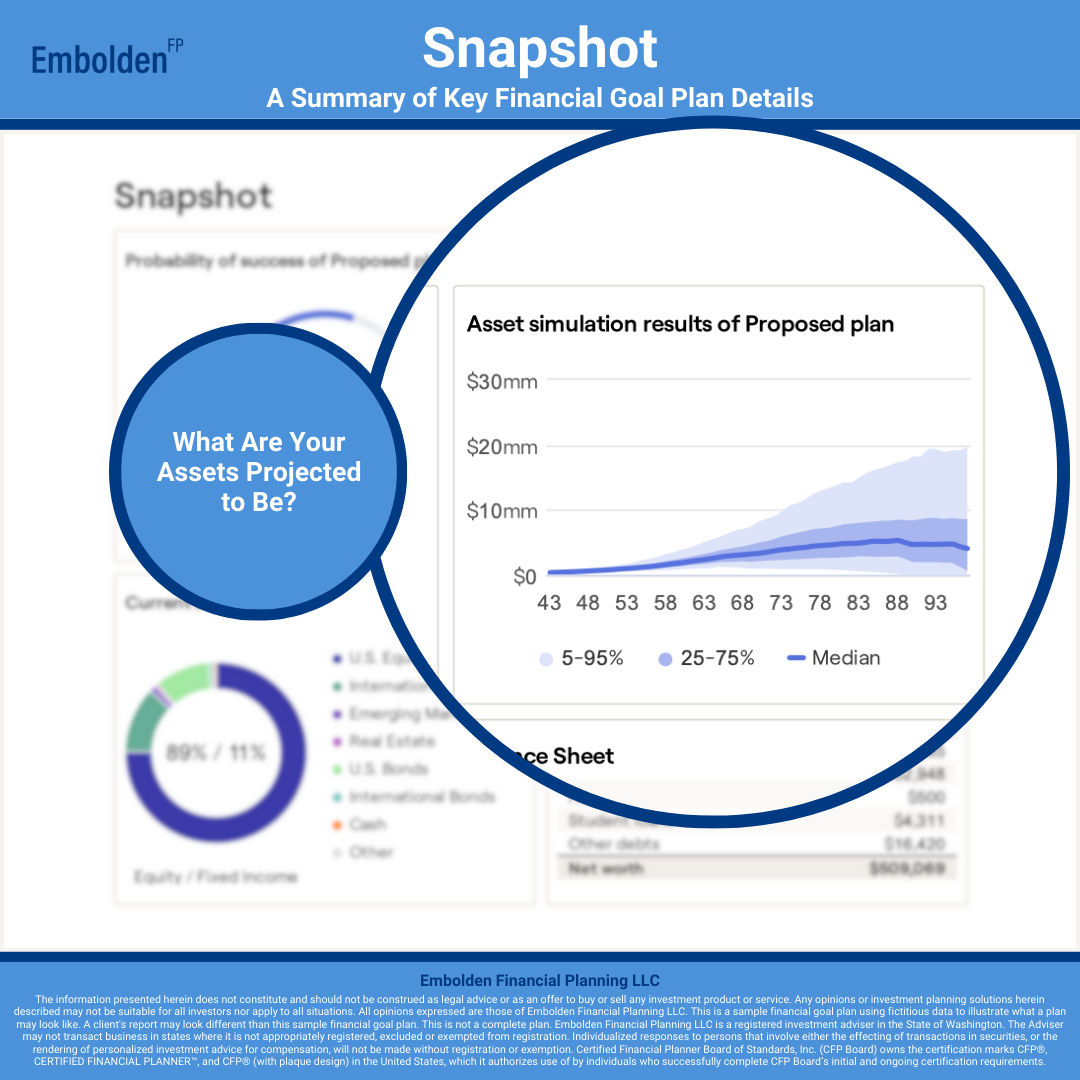

Homer and Marge can see their projected assets over time.

The dark blue line shows their projected median, or midpoint, asset value over time. Half the time the asset value will be more, and half the time it will be less. They can also see in what range their assets are projected to be both 50% and 90% of the time.

-

![Snapshot Current Allocation Financial Goal Plan]()

89% of their investment portfolio is in stocks, and 11% is in bonds.

Equities, or stocks, typically have a greater return potential than Fixed Income, or bonds. Also, Equities are typically more volatile than Fixed Income. Homer and Marge can see that their current allocation is heavily weighted towards more risky, higher-return oriented investments.

-

![Snapshot Net Worth Financial Goal Plan]()

Homer and Marge can now see their net worth on their personal Balance Sheet.

They shared all of their financial information, including assets and liabilities, and now they have their very own Balance Sheet. They securely linked their accounts to Embolden Financial Planning LLC's financial planning platform called RightCapital and can now see their net worth updated on a daily basis.

-

![Balance Sheet Summary Financial Goal Plan]()

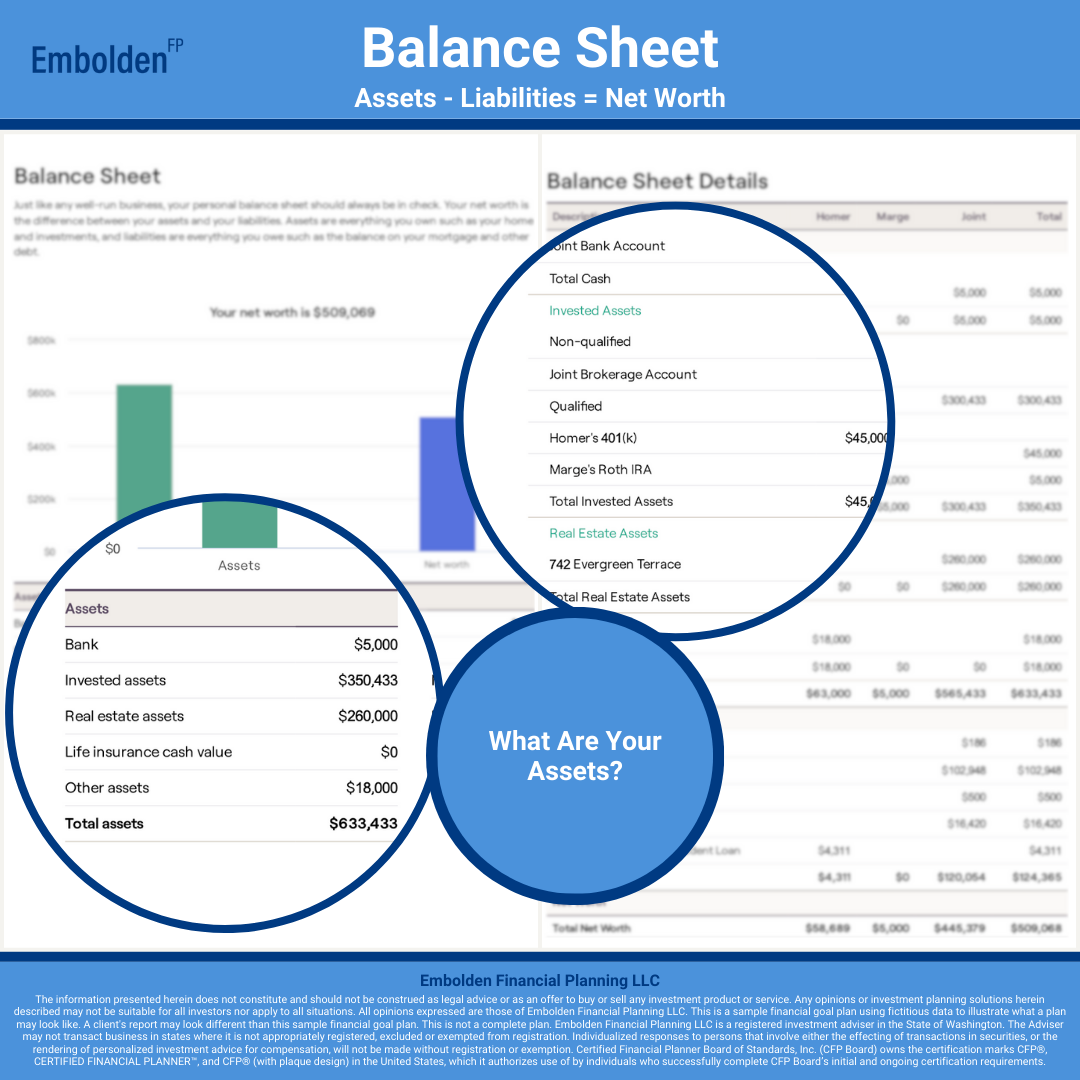

Here is Homer and Marge's Balance Sheet with all of the details.

They can see all of their assets, liabilities, and net worth in one place.

-

![Balance Sheet Assets Financial Goal Plan]()

Homer and Marge can see their assets.

They have bank accounts, investment accounts, a home, and a car.

-

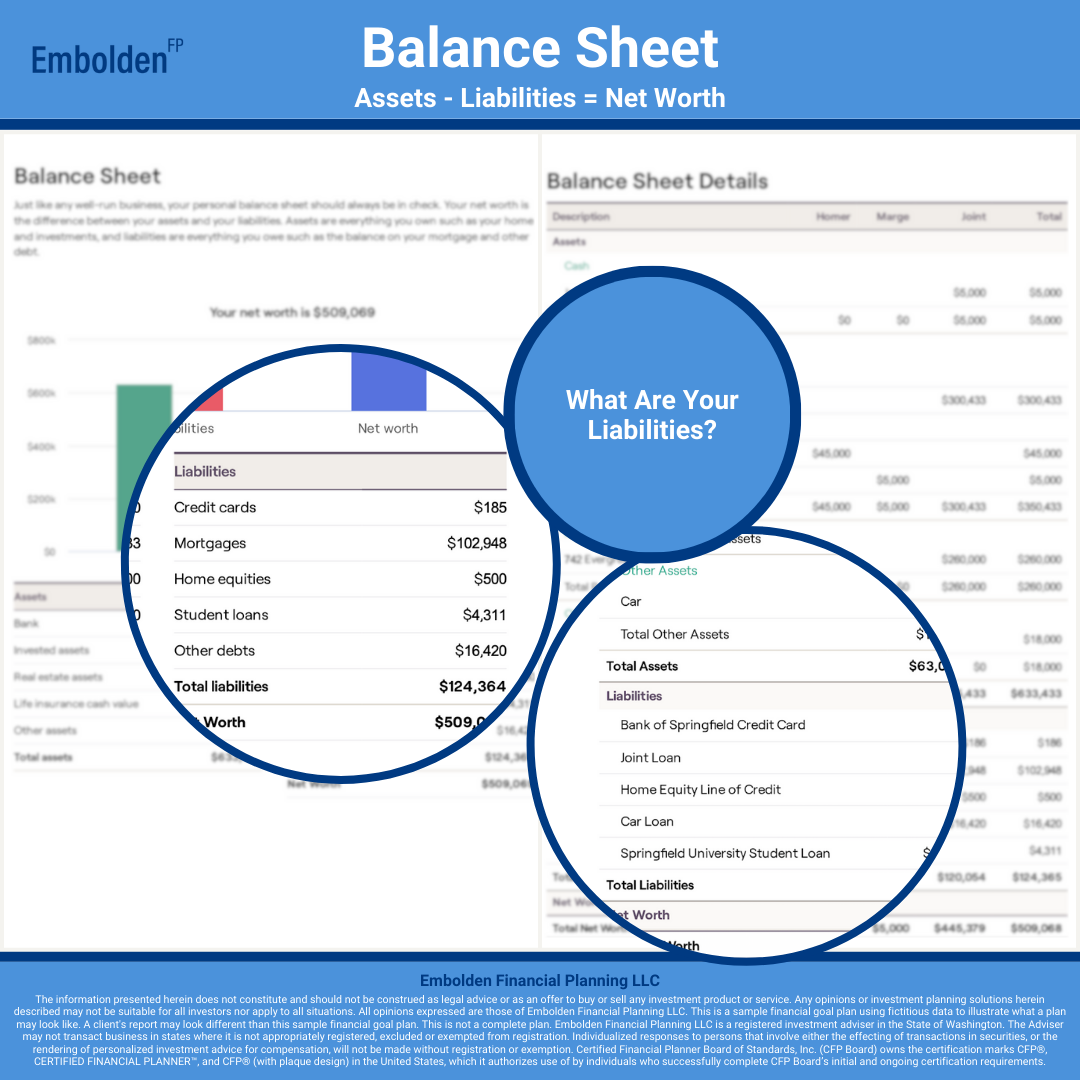

![Balance Sheet Liabilities Financial Goal Plan]()

They can see their liabilities.

Homer and Marge have a credit card, a mortgage, a home equity line of credit balance, a car loan, and a student loan.

-

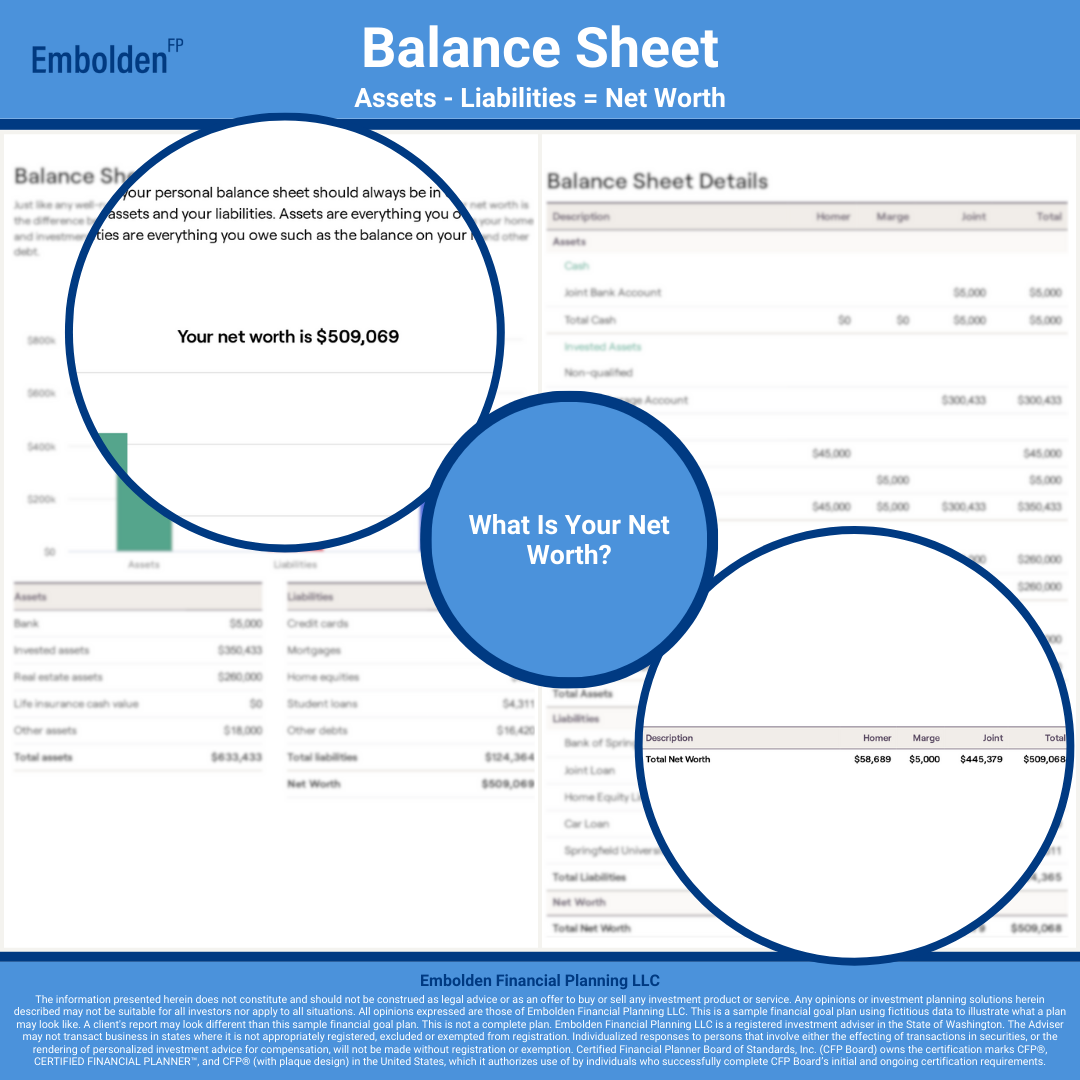

![Balance Sheet Net Worth Financial Goal Plan]()

And now Homer and Marge can see their net worth.

The difference between their assets and liabilities.

-

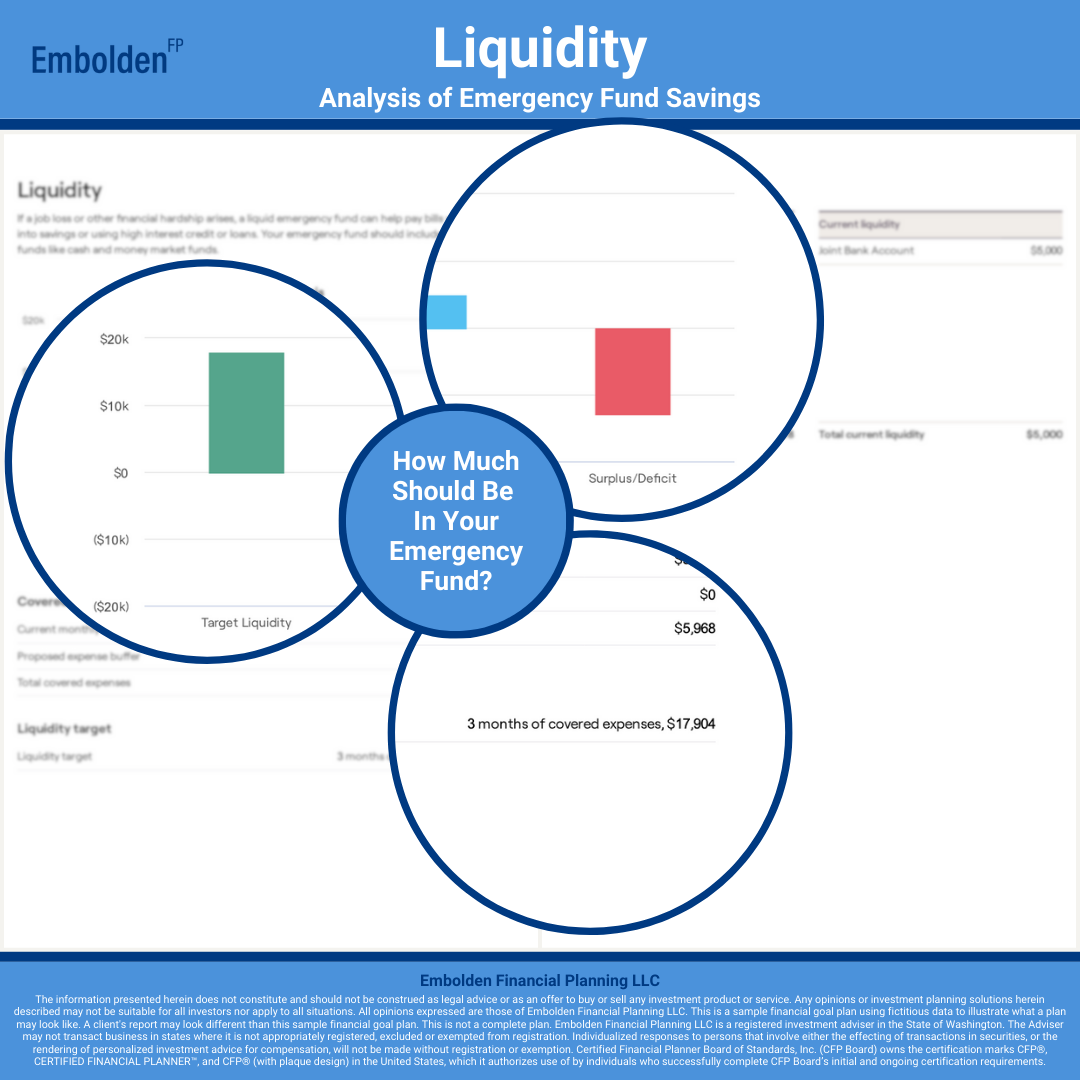

![Liquidity Summary Financial Goal Plan]()

Homer and Marge have an Emergency Fund.

After a conversation with Embolden Financial Planning LLC about their Emergency Fund, an amount of liquid savings set aside for emergency cash needs, they decided they would like to keep three months worth of living expenses in their Emergency Fund. This fund will be used only for emergency purposes, like unexpected medical expenses, emergency home repairs, or job losses.

-

![Liquidity Current Financial Goal Plan]()

This is Homer and Marge's Emergency Fund.

They have it in the same bank account they use for all of their expenses.

-

![Liquidity Target Financial Goal Plan]()

This is how much they want in their Emergency Fund.

It looks like Homer and Marge need to set aside some additional cash to hit the Emergency Fund target. They may want to set up a separate bank account and name it "Emergency Fund" so that it is clear what the money is for.

-

![Budget Summary Financial Goal Plan]()

Homer and Marge have a budget.

They weren't sure where their money was being spent. After securely linking their accounts to the financial goal-planning platform, Embolden Financial Planning LLC completed a review of their transactions, and then they worked together to establish a budget.

-

![Budget Actual Financial Goal Plan]()

Now they know what they are spending.

Housing, utilities, groceries, and loan payments are just a few examples of the categories that Homer and Marge's expenses fall under.

-

![Budget Target Financial Goal Plan]()

Now they know what they want to spend.

This will help Homer and Marge stay on track to achieve their financial goals.

-

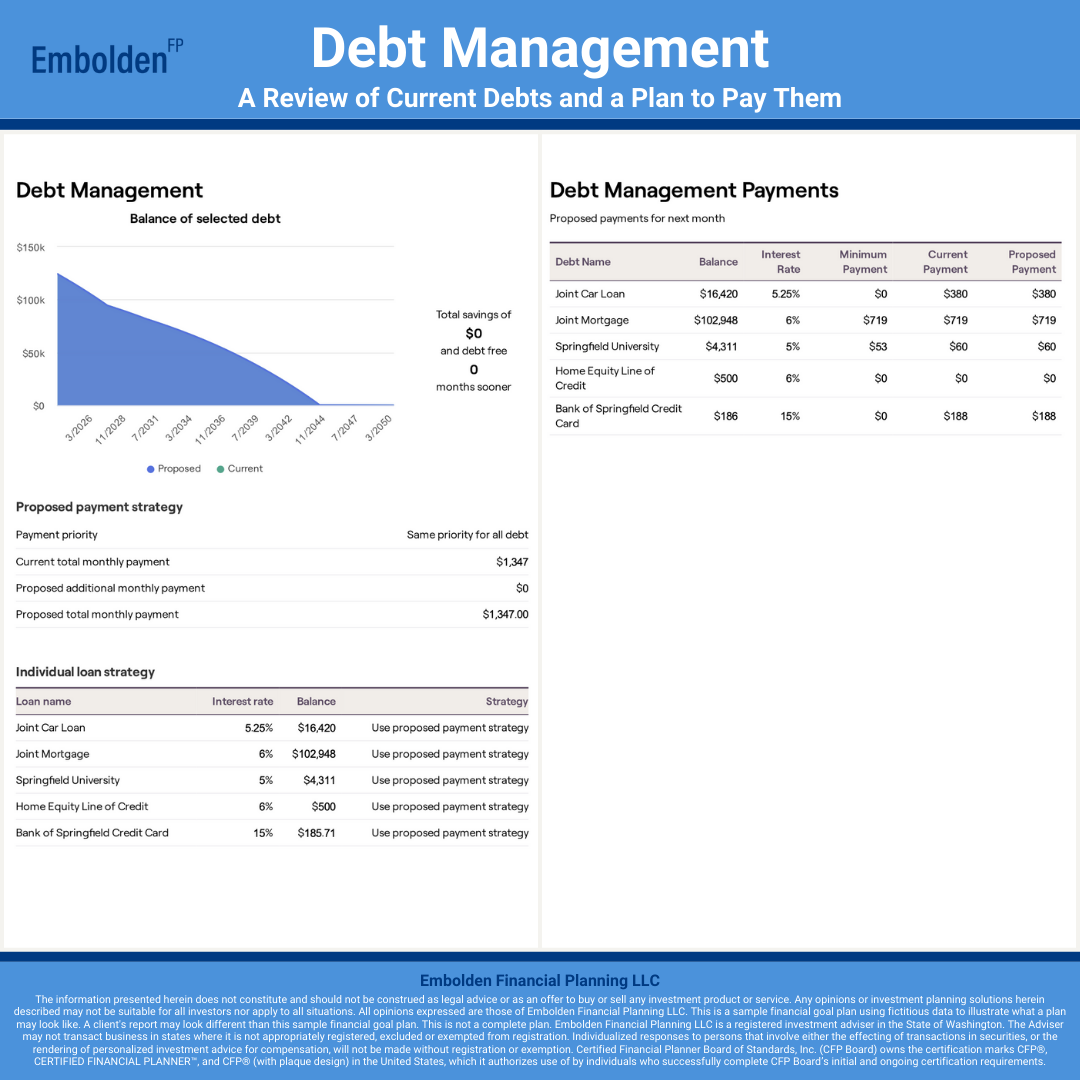

![Debt Management Summary Financial Goal Plan]()

Homer and Marge have some debts.

After sharing information about their debt with Embolden Financial Planning LLC and discussing different strategies for debt repayment, they now have a plan for managing their debts.

-

![Debt Management Current Financial Goal Plan]()

They have a clear understanding of what their debts are.

Who is owed, what the balance owed is, and the interest rate on the debt.

-

![Debt Management Target Financial Goal Plan]()

And now they have a strategy for how to pay the debts.

The strategy that Homer and Marge decided on was to maintain their current payment schedule.

-

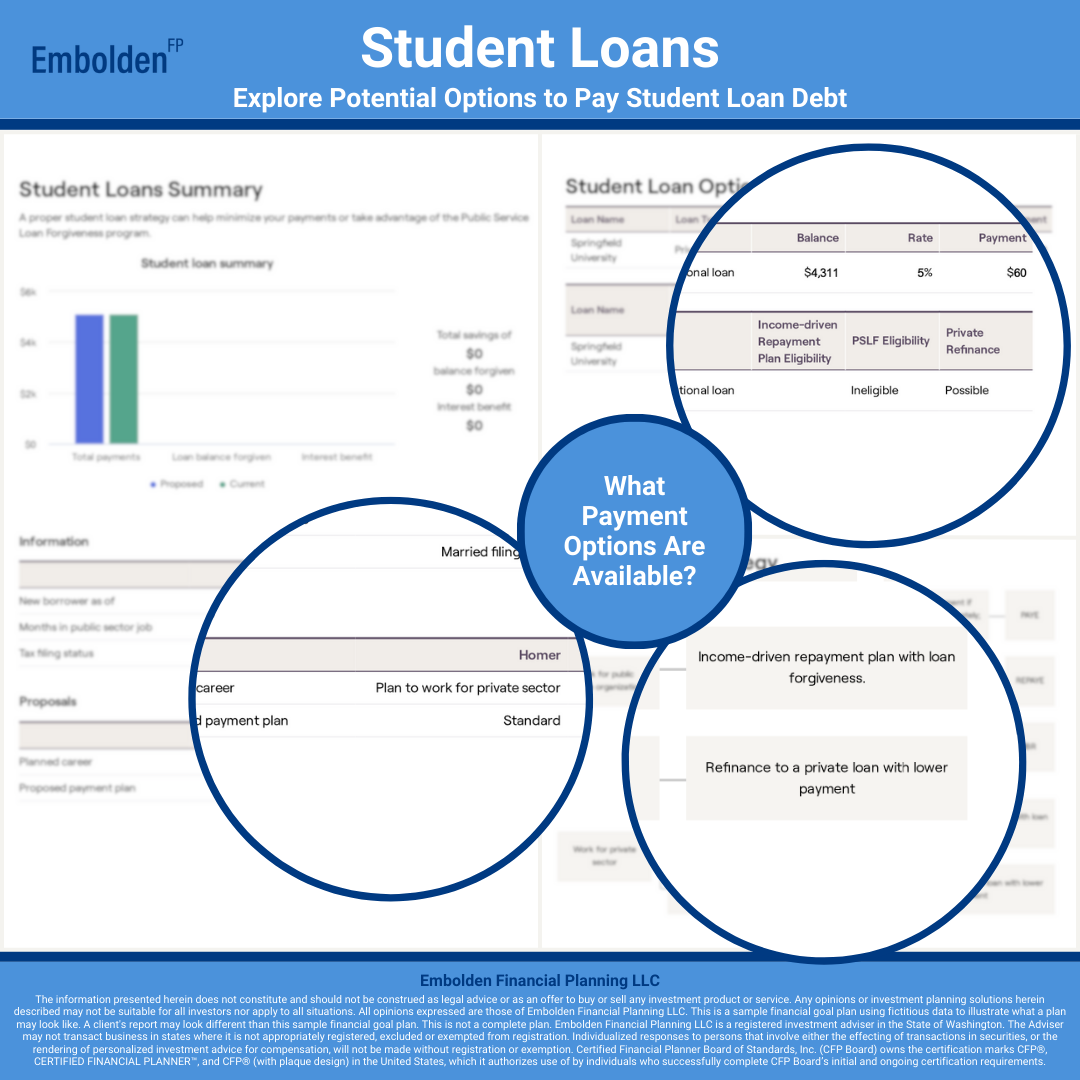

![Student Loans Current Financial Goal Plan]()

Homer has some student loan debt.

Student loan debt has unique options for repayment, or in some cases, forgiveness. Embolden Financial Planning LLC did some analysis to see if there were any options that could help with repayment.

-

![Student Loans Payment Options Financial Goal Plan]()

Homer doesn't have a lot of options.

He works in the private sector, which eliminated the options available to public sector employees. He only has one loan, so consolidation may not make sense. He may be able to qualify for income-driven repayment.

-

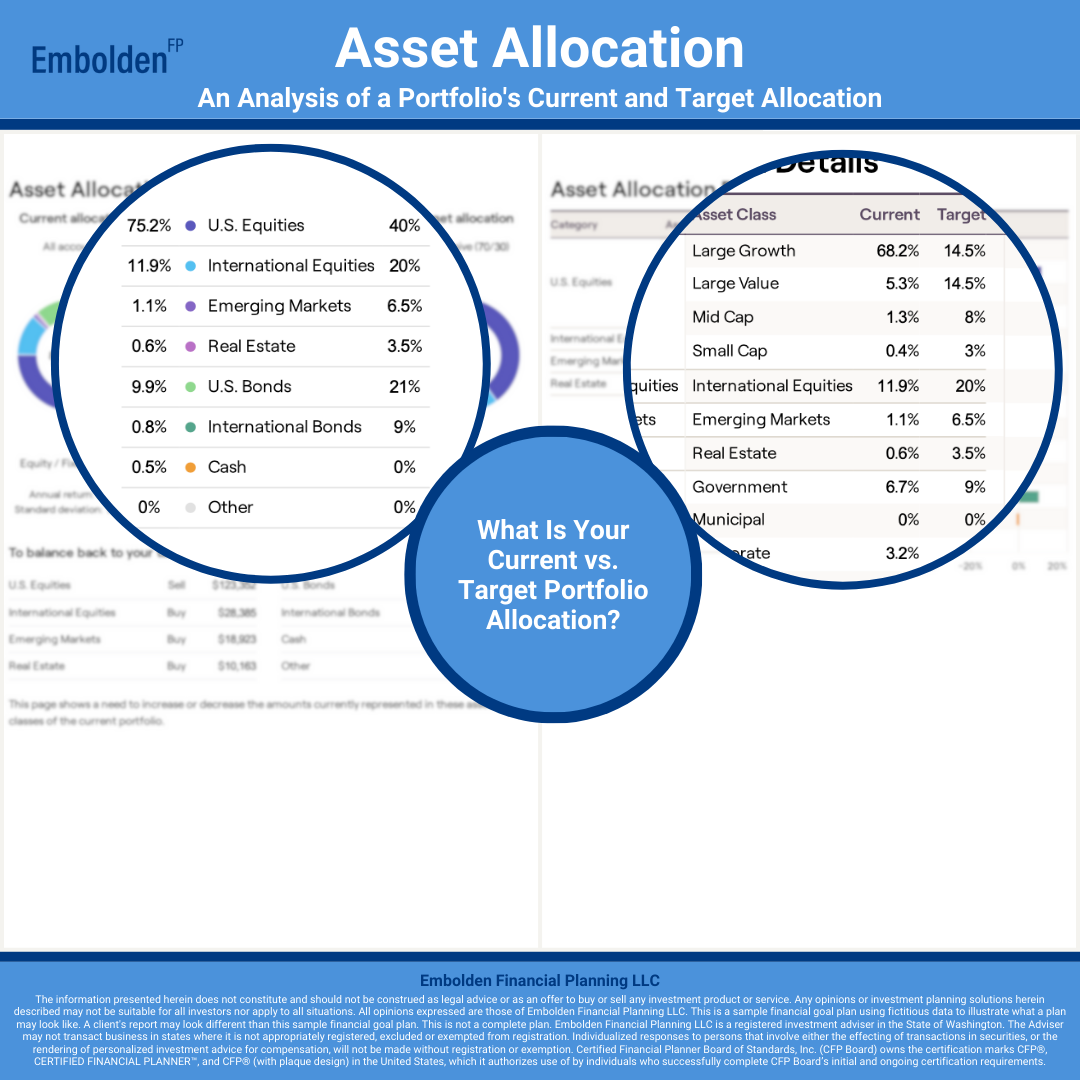

![Asset Allocation Summary Financial Goal Plan]()

Homer and Marge have decided on a target asset allocation.

After they each completed a Risk Tolerance Questionnaire, they had a discussion with Embolden Financial Planning LLC about the appropriate level of risk to take with their investments, what amount of risk would allow them to sleep soundly at night, and how it impacted their financial goal plan. They made the decision to reduce the risk in their portfolio by reducing the allocation to Equities and increasing the allocation to Fixed Income.

-

![Asset Allocation Current vs Target Financial Goal Plan]()

This is how their current allocation compares to their target allocation.

Embolden Financial Planning LLC will provide specific trade recommendations to bring their portfolio in line with the target allocation in a tax efficient manner. Next year, when Homer and Marge meet for their annual review, Embolden Financial Planning LLC will offer recommendations to bring their portfolio back to target if needed.

-

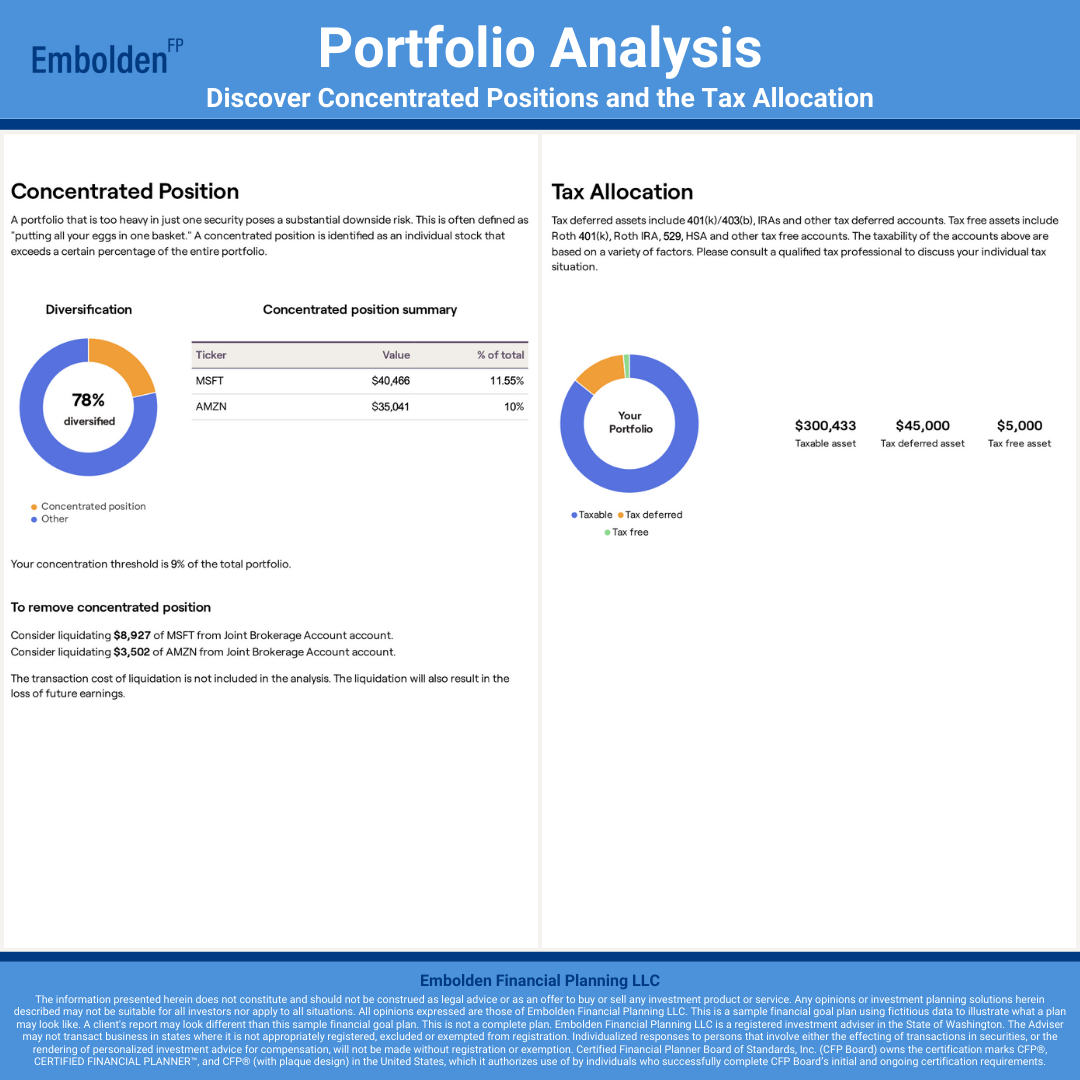

![Portfolio Analysis Summary Financial Goal Plan]()

Homer and Marge have some concentrated positions and a lot of taxable assets.

They are big fans of Amazon and Microsoft and have been aggressively purchasing those stocks. And a lot of their investments are in taxable accounts.

-

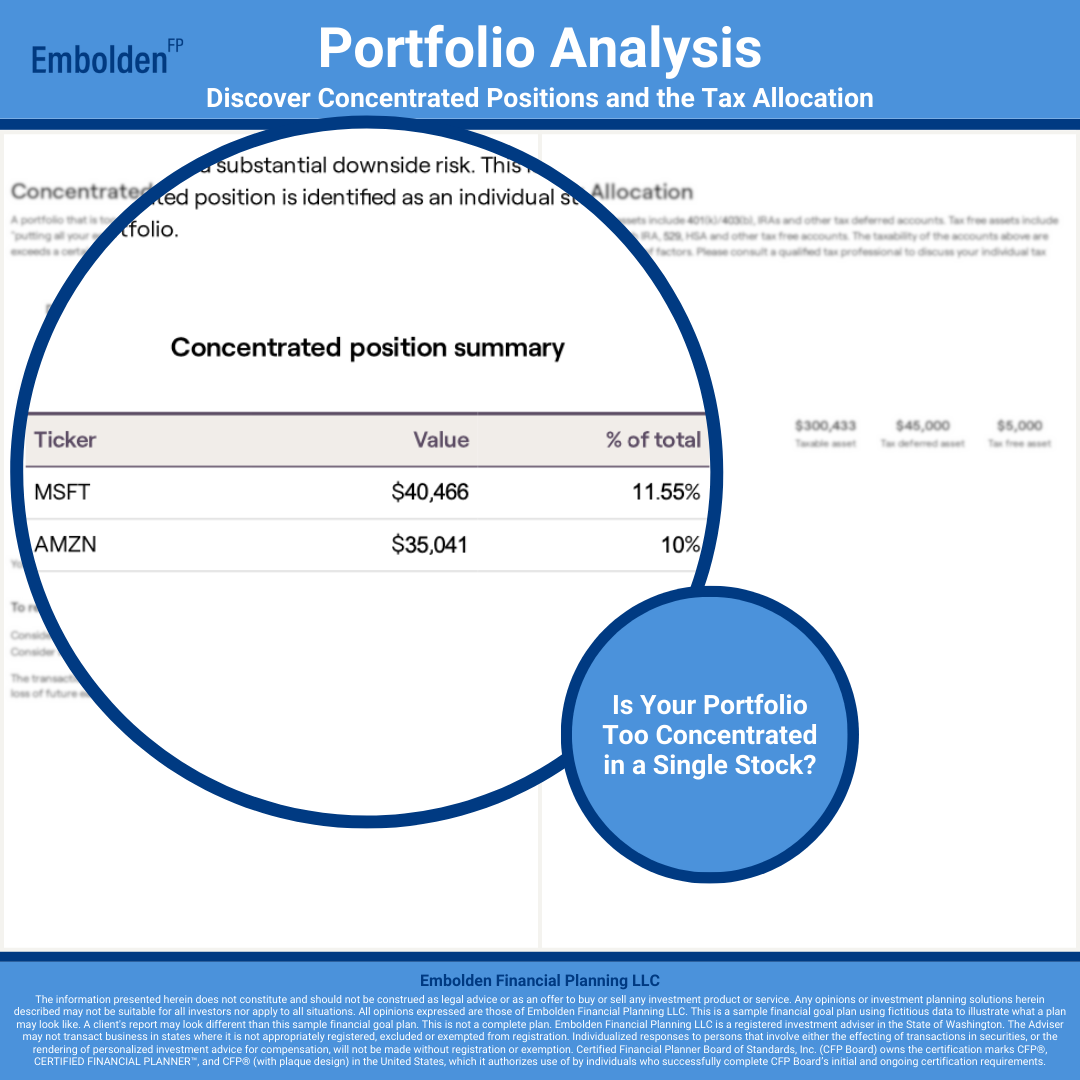

![Portfolio Analysis Concentrated Position Financial Goal Plan]()

They want a strategy for reducing their concentrations.

After working with Embolden Financial Planning LLC, Homer and Marge now have a strategy. They will sell a portion of these shares over the next few years to spread the tax liability over multiple tax years.

-

![Portfolio Analysis Tax Allocation Financial Goal Plan]()

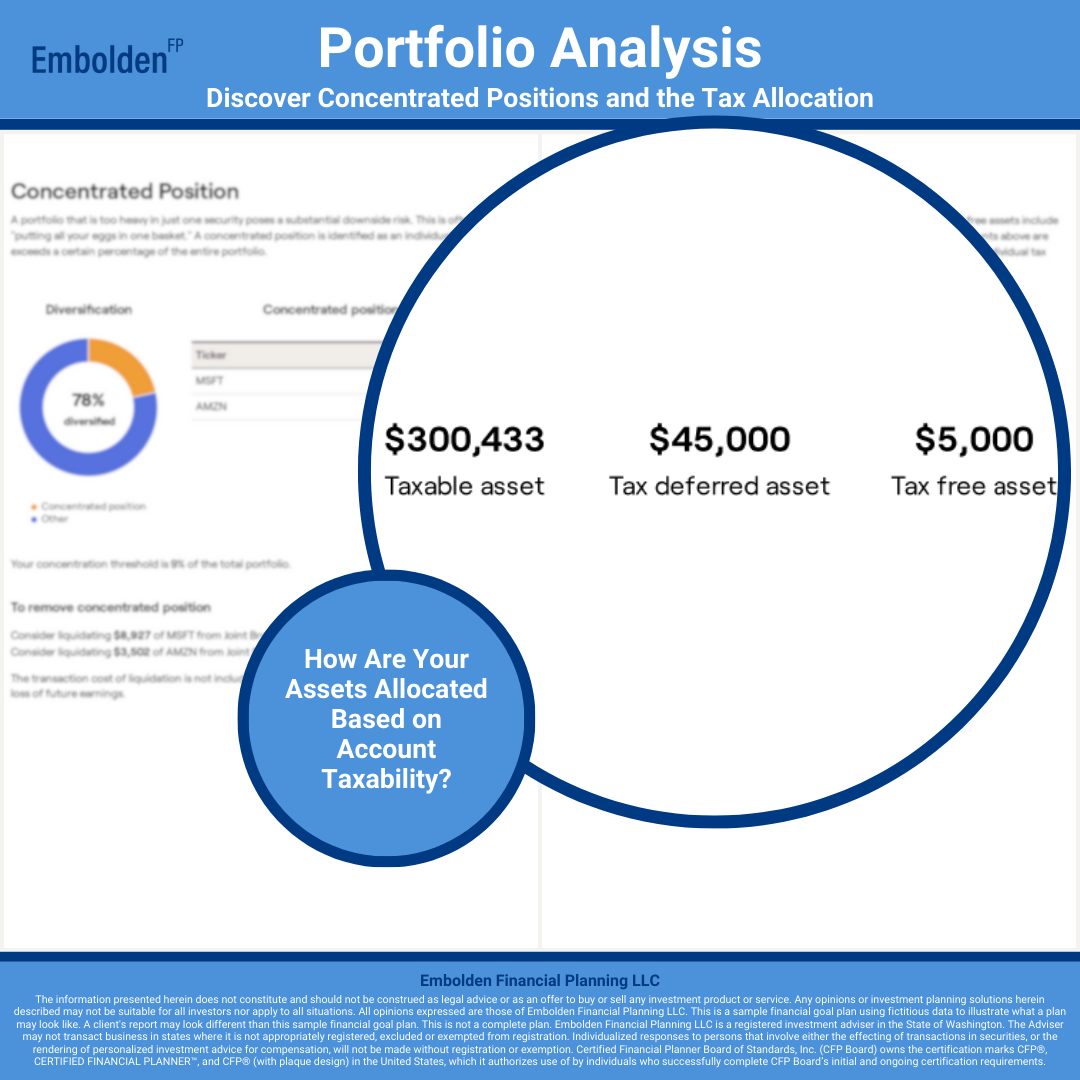

Homer and Marge now see how their accounts are allocated based on taxability.

And they are planning on making contributions to tax-deferred and tax-exempt investment accounts because that is what works best for their financial goal plan.

-

![Analyze Test Summary Financial Goal Plan]()

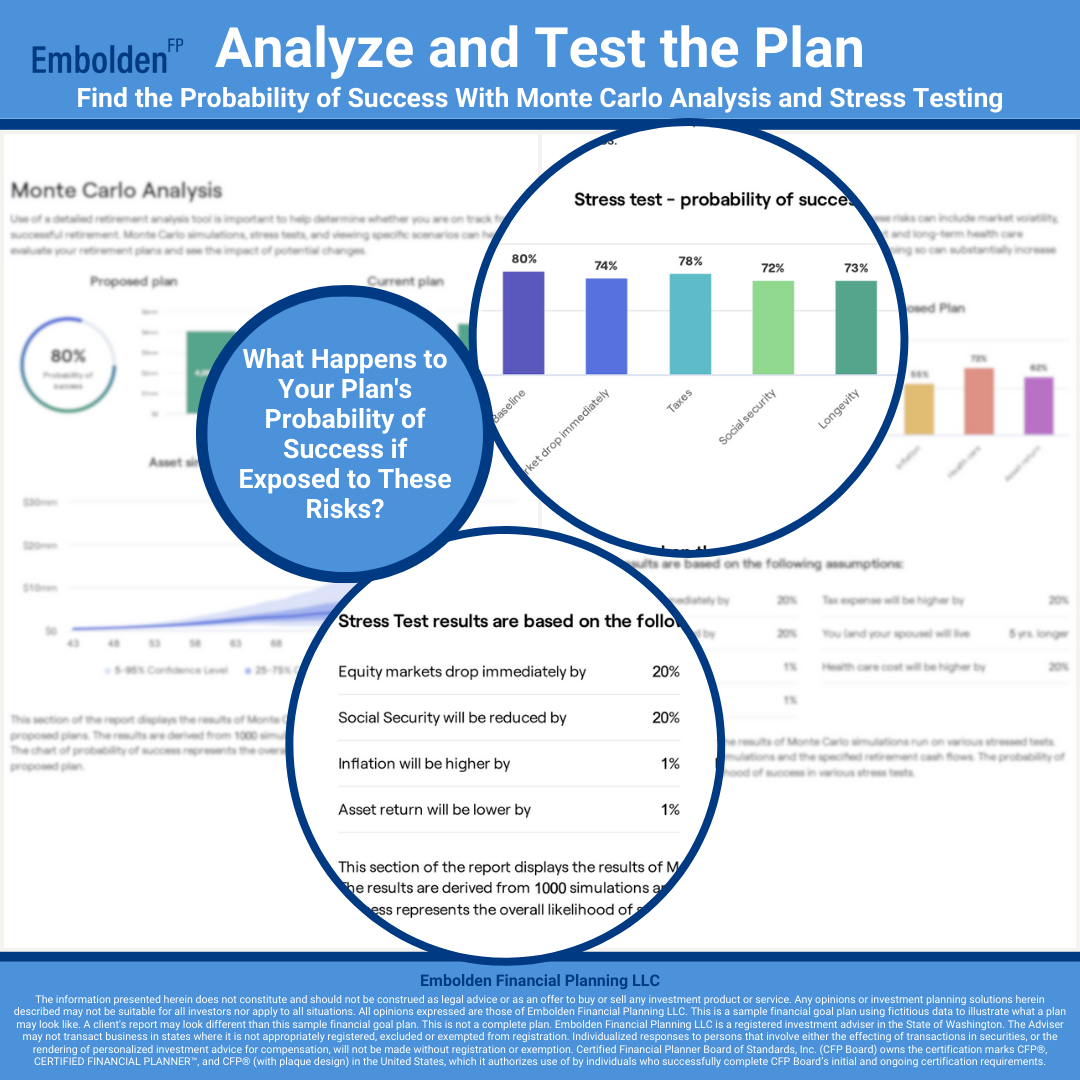

Homer and Marge's financial goal plan has been analyzed and tested.

Their financial goal plan was run through 1,000 Monte Carlo simulations of potential risk and return scenarios. To determine how the occurrence of various risks would affect the plan, it was stress-tested.

-

![Analyze Test Monte Carlo Financial Goal Plan]()

The probability of success for Homer and Marge's plan is 80%.

Which is to say that the probability that their plan will not run out of money in any year is 80%.

-

![Analyze Test Stress Financial Goal Plan]()

Different risks will have a negative impact on the probability of success.

The probability of success may drop by up to 8% if risks like a 20% reduction in social security, higher than expected inflation, or lower returns on assets occur.

-

![Savings Retirement Summary Financial Goal Plan]()

Homer and Marge have a savings plan and a retirement spending plan.

They can see the projected savings plan for each year until retirement. And for their retirement years, they can see the projected income and expenses for each year.

-

![Savings Retirement Now Future Financial Goal Plan]()

This is how they are going to save for their future goals.

The majority of Homer and Marge's savings are projected to be saved for the goal of retirement, but they also plan to save for their kids future education.

-

![Savings Retirement Income Spending Financial Goal Plan]()

And when Homer and Marge retire, this is how they are going to fund it.

They are going to rely on savings and social security benefits for the majority of their retirement expenses.

-

![Social Security Summary Financial Goal Plan]()

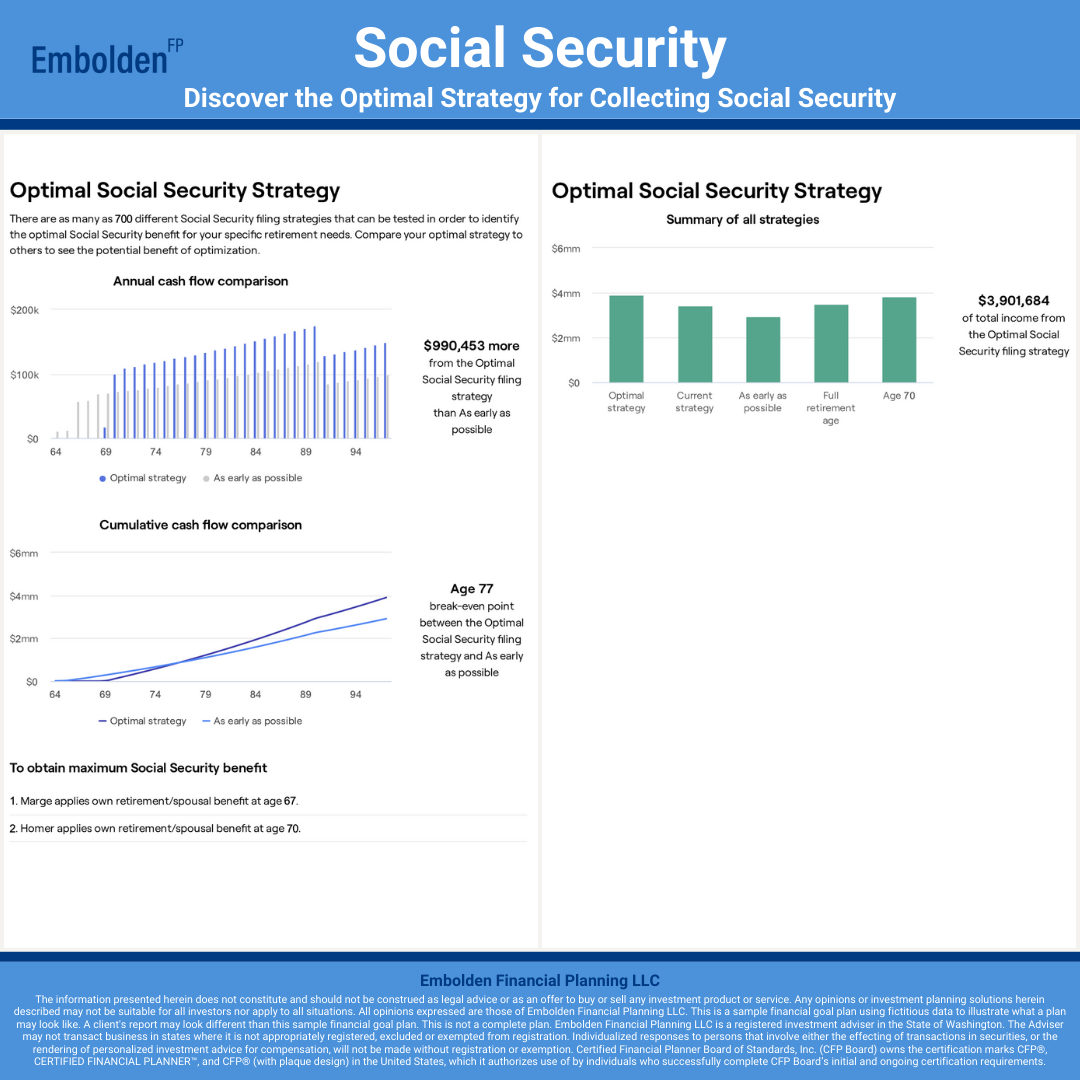

Homer and Marge want to collect as much as they can from social security.

After receiving copies of their social security statements, Embolden Financial Planning LLC was able to present the optimal strategy for collecting social security benefits.

-

![Social Security Start Collecting Financial Goal Plan]()

It looks like it makes the most sense for them to file at different ages.

If Homer and Marge follow the optimal strategy, the plan projects a significant difference in the total amount they receive.

-

![Social Security Optimal Strategy Financial Goal Plan]()

This is when Homer and Marge are projected to break even.

When compared to collecting social security early, this is the age where waiting begins to pay off for them.

-

![Medicare Summary Financial Goal Plan]()

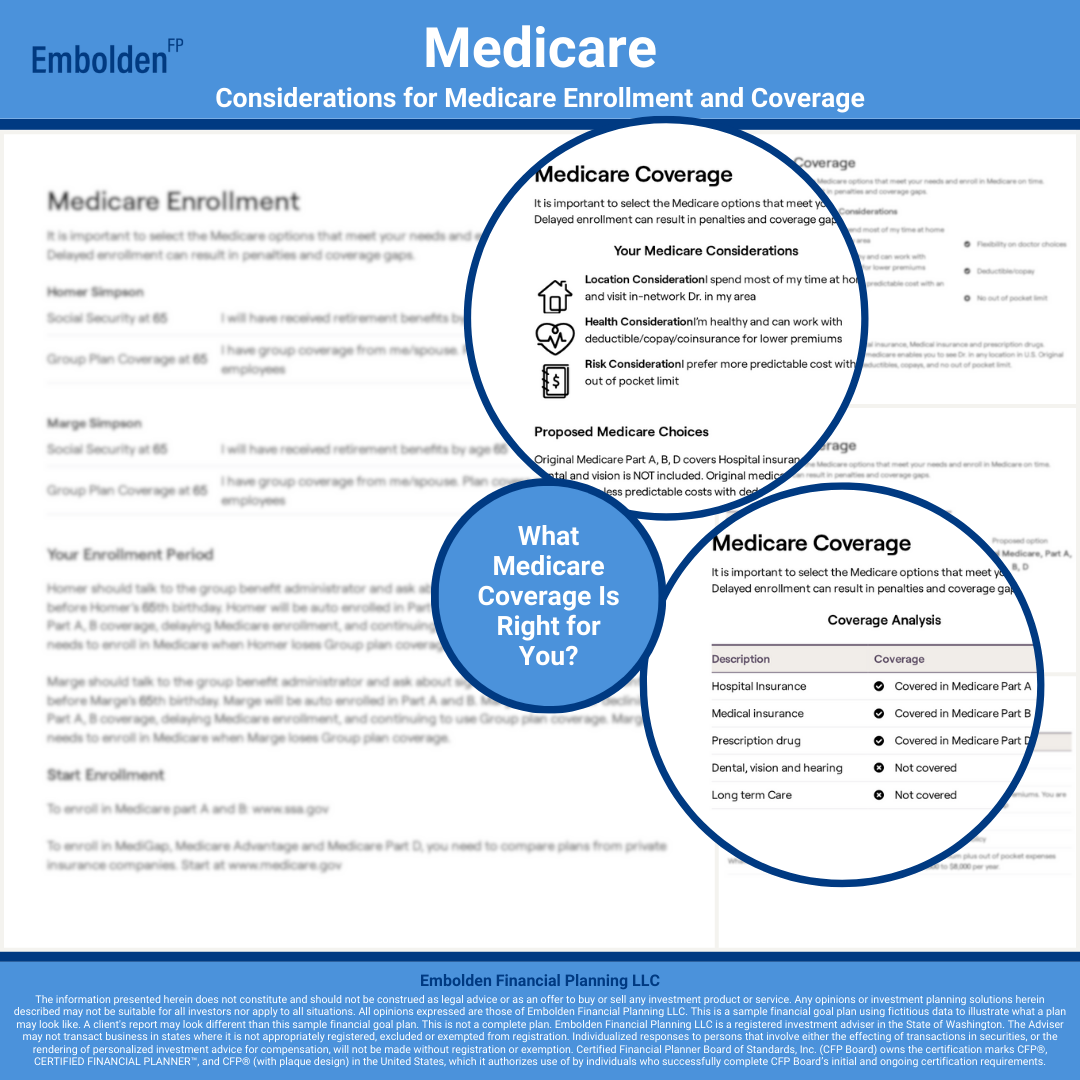

Homer and Marge aren't really thinking about Medicare right now.

But now they know what may impact their Medicare decisions, and they have a resource for things to consider when the time comes.

-

![Medicare Enrollment Coverage Tips Financial Goal Plan]()

The Medicare coverage they choose depends on several variables.

The variables include potential employer coverage, where they will live in retirement, and their health status. Homer and Marge are planning to schedule a meeting with Embolden Financial Planning LLC to talk about Medicare when the time comes to make a decision.

-

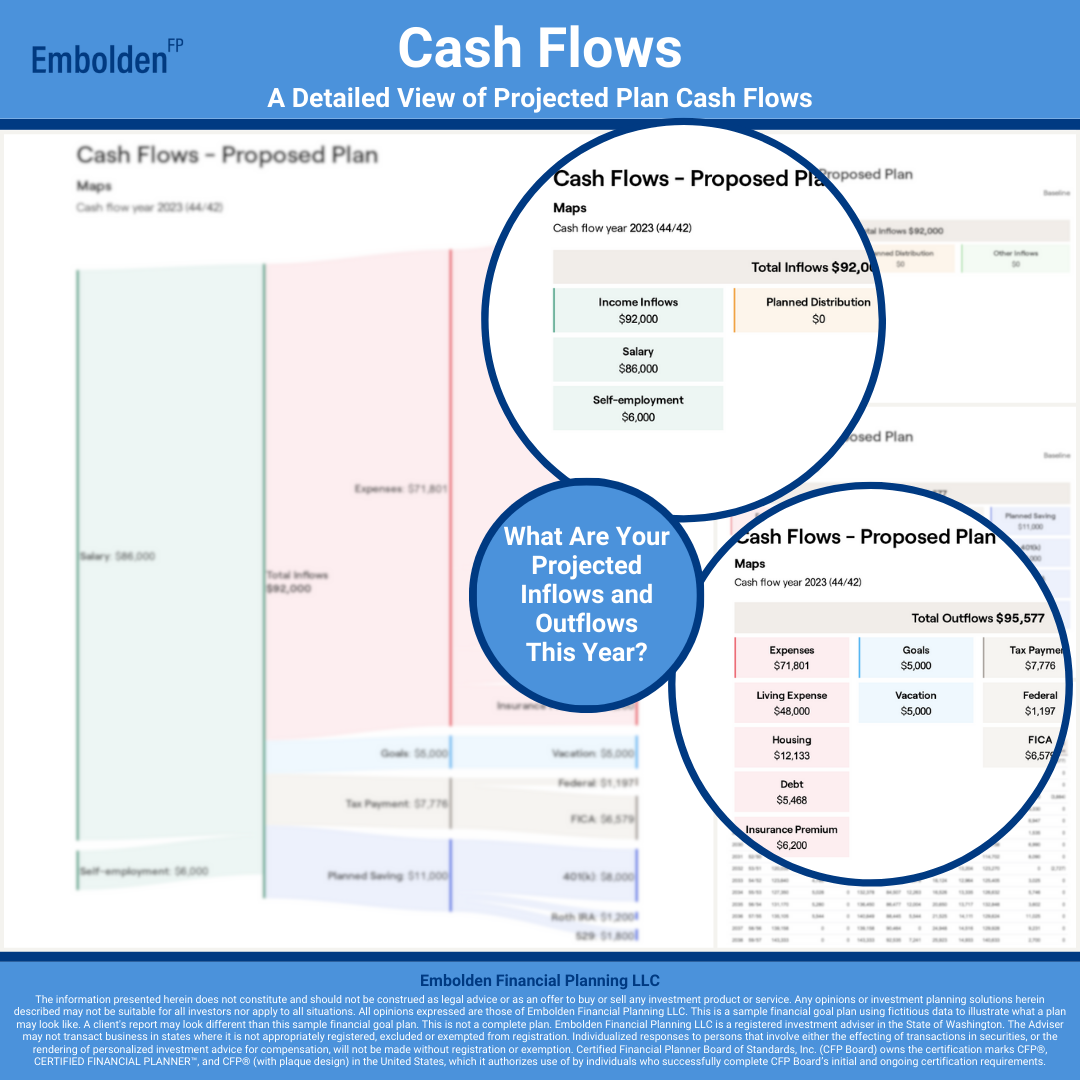

![Cash Flow Summary Financial Goal Plan]()

Homer and Marge like the different ways of viewing the numbers.

It's helpful to see the colorful breakdown of projected cash flows for the current year. It's really helpful to see the detailed projected cash flows for future years.

-

![Cash Flow Current Projection Financial Goal Plan]()

It looks like they are projected to spend a little more than they earn this year.

Now Homer and Marge can easily see where the money is going and where they might make an adjustment.

-

![Cash Flow Annual Financial Goal Plan]()

It looks like Homer and Marge will be back on track next year.

They are projected to have cash in excess of their planned savings available to spend.

-

![Life Insurance Summary Financial Goal Plan]()

Homer has life insurance, but they were curious if it was enough.

Embolden Financial Planning LLC reviewed their existing life insurance coverage and how it would support the surviving spouse through the end of their financial goal plan.

-

![Life Insurance How Much Financial Goal Plan]()

It looks like they have sufficient life insurance coverage for their needs.

Homer actually has more life insurance than he is projected to need. Embolden Financial Planning LLC does not sell insurance or earn any commissions, so if insurance is recommended for a client, it is because it is believed to be in the client's best interest. Homer and Marge are comfortable with having more insurance than is needed, so no action is needed.

-

![Disability Insurance Summary Financial Goal Plan]()

Homer has disability insurance, but they were unsure if it was enough.

Embolden Financial Planning LLC reviewed their existing disability insurance coverage and how it would support them and the success of their financial goal plan.

-

![Disability Insurance How Much Financial Goal Plan]()

It looks like they have sufficient life insurance coverage for their needs.

Homer's policy through his employer is projected to cover 49% of his income if there is a disability that prevents him from working. Homer and Marge decided in conversation with Embolden Financial Planning LLC that they did not need additional coverage.

-

![Long-Term Care Insurance Summary Financial Goal Plan]()

Homer and Marge each have long-term care insurance policies.

They saw how expensive and important additional care for their aging parents was, so they spoke with an insurance broker and obtained long-term care insurance policies.

-

![Long-Term Care Insurance How Much Financial Goal Plan]()

They have sufficient long-term care insurance coverage.

After a review of their projected plan, which incorporated an increase in living expenses in the last years of their plan related to aging and diminished mobility, it was determined that Homer and Marge would be able to self insure for the expenses that their long-term care insurance policies did not cover.

-

![Property Casualty Insurance Summary Financial Goal Plan]()

Homer and Marge have property and casualty insurance in place.

Homeowner's insurance to protect their home. Auto insurance for bodily injuries and destruction of property. Umbrella insurance for additional liability coverage.

-

![Property Casualty Insurance How Much Financial Goal Plan]()

They do need to make an adjustment to their coverage.

After a discussion with Embolden Financial Planning LLC, it was determined that an appropriate level of coverage was 80% of Homer and Marge's home value and that they would need to increase their coverage. They meet the state required minimums for auto insurance coverage, so no addition is needed. After analyzing their financial plan and existing liability coverage, Embolden Financial Planning LLC believes there is no need for umbrella insurance at this time.

-

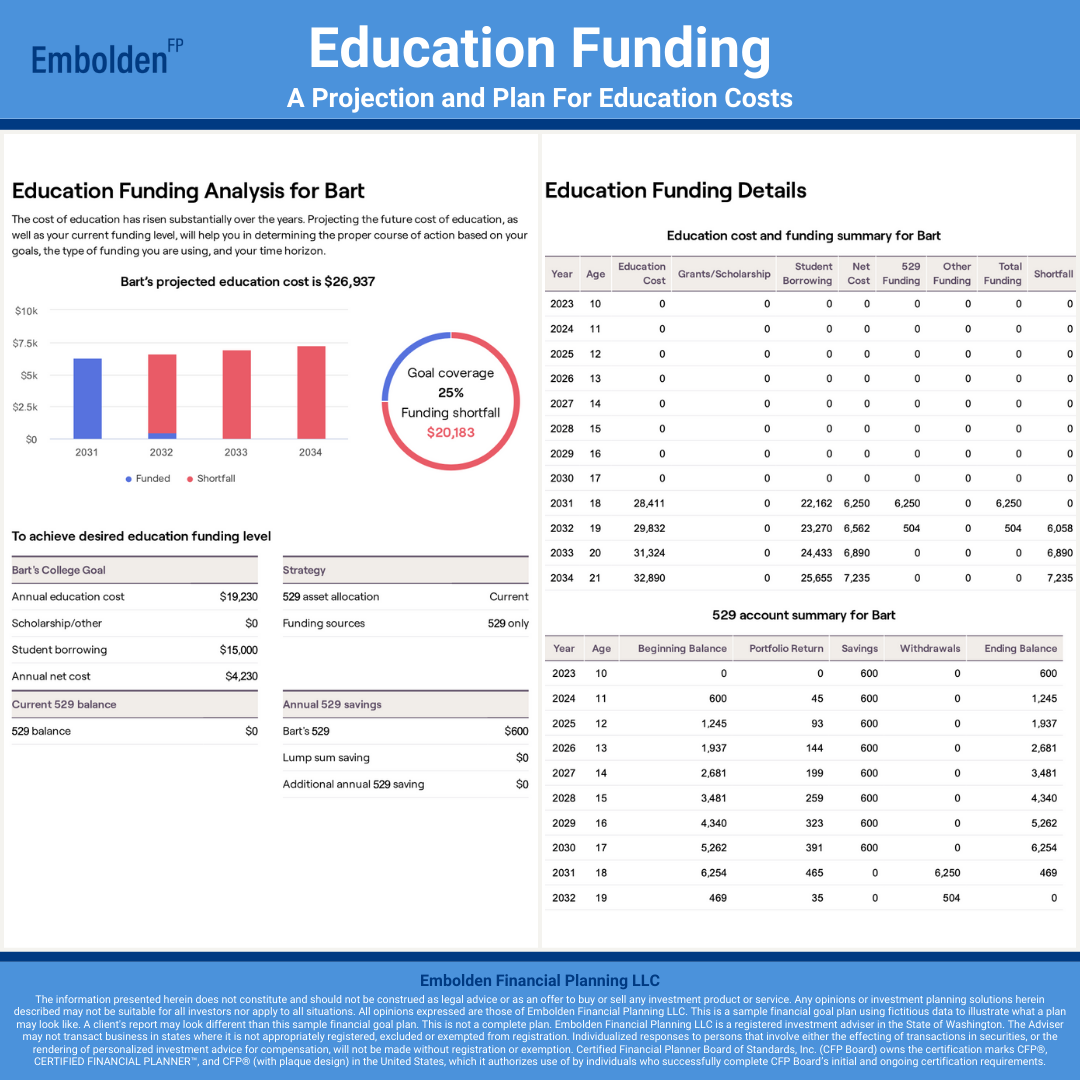

![Education Funding Summary Financial Goal Plan]()

Homer and Marge are planning for all three of their children to go to college.

They wanted to know how much they would need to save for each child and how that would impact their financial goal plan.

-

![Education Funding Cost Financial Goal Plan]()

This is the education funding analysis for their oldest son, Bart.

Based on the projected cost of college, scholarships, and student borrowing, Homer and Marge have a target amount that they would like to save to help Bart through college. They have set up a 529 College Savings plan and will make annual contributions. Embolden Financial Planning LLC completed this education analysis for each of their three children.

-

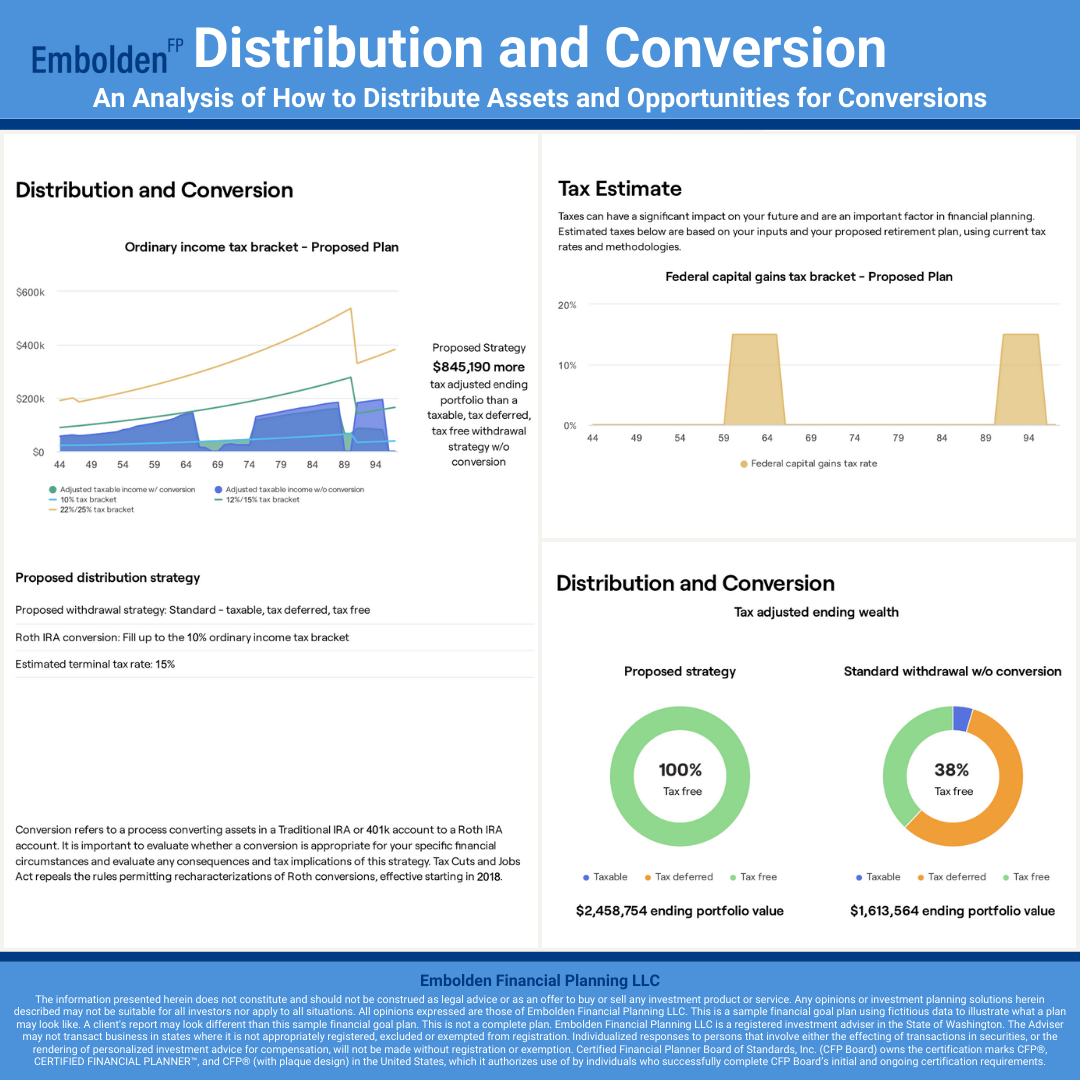

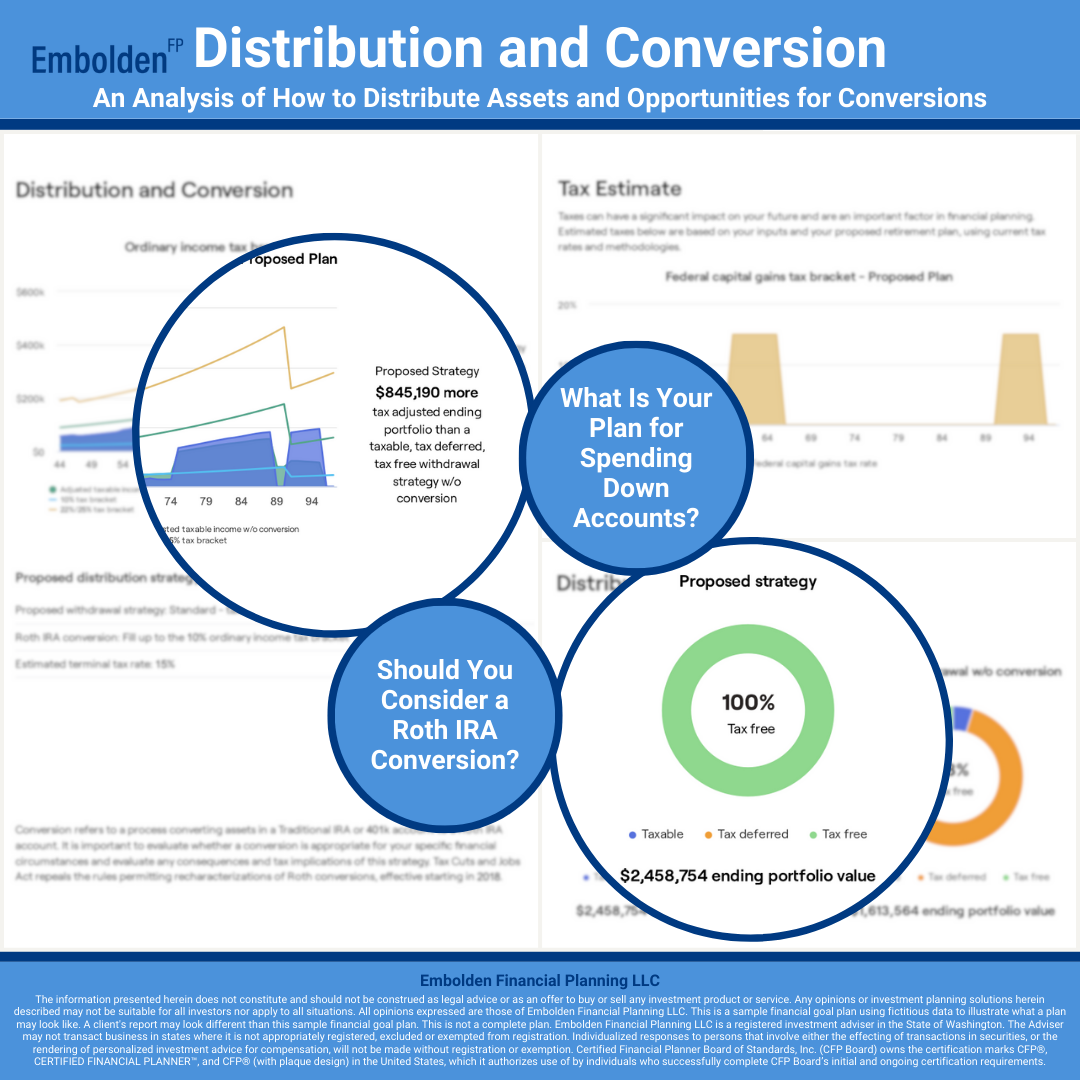

![Distribution Conversion Summary Financial Goal Plan]()

Homer and Marge have a plan for some Roth IRA conversions.

Embolden Financial Planning LLC analyzed projected income, timing, and tax brackets to find opportunities to initiate conversions.

-

![Distribution Conversion Spending Roth IRA Financial Goal Plan]()

Roth IRA conversions may significantly increase their portfolio value.

If Homer and Marge complete the conversion of tax-deferred accounts into tax-free accounts at the right time, it is projected to help increase their portfolio value.

-

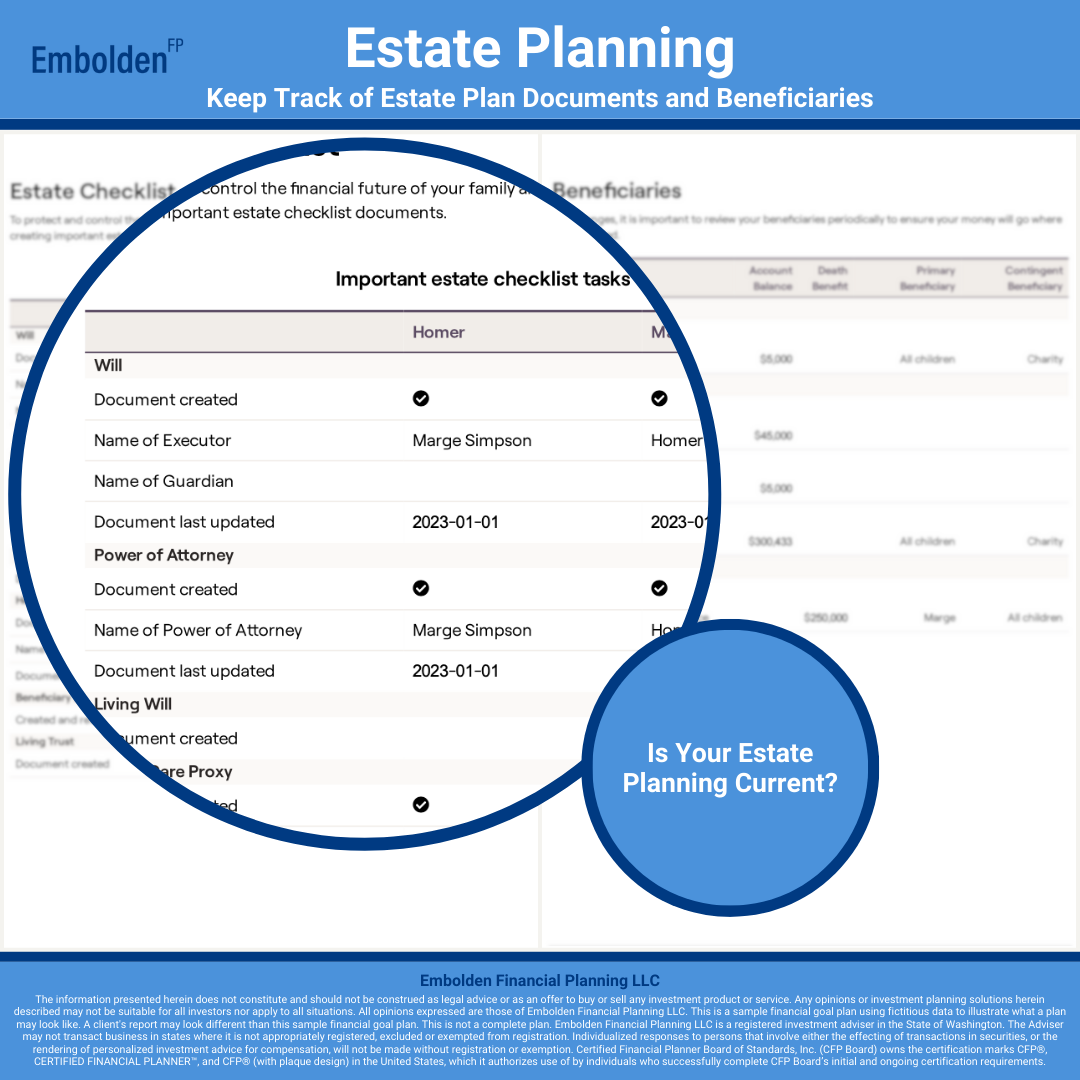

![Estate Planning Checklist Beneficiary Summary Financial Goal Plan]()

Homer and Marge have an estate plan in place.

Embolden Financial Planning LLC completed a review of the documents they set uo with an estate planning attorney and created a report to keep track. Additionally, a review of how beneficiaries were setup on their accounts was completed.

-

![Estate Planning Checklist Beneficiary Current Financial Goal Plan]()

Everything looks complete and up-to-date.

When Homer and Marge meet for their annual reviews with Embolden Financial Planning LLC, this may be one of the topics they discuss in order to make sure the plan is still appropriate.

-

![Estate Planning Checklist Beneficiary Review Financial Goal Plan]()

All of Homer and Marge's accounts have the correct beneficiaries.

If any accounts had missing beneficiaries or if the beneficiaries were no longer correct, Embolden Financial Planning LLC would make a recommendation to update that information.

-

![Estate Planning Illustration Summary Financial Goal Plan]()

Here is an illustration of Homer and Marge's estate plan.

They can see how their assets will flow and to whom at the end of their lives. This is based on their actual estate plan and projected asset values.

-

![Estate Planning Illustration What Happens Financial Goal Plan]()

It is very helpful to see where the assets are going.

Homer and Marge would like to be more charitable with their assets. This illustration helped make it clear that they hadn't left any of their estate to charitable causes. They've scheduled a meeting with Embolden Financial Planning LLC for a focused discussion about charitable giving strategies.

-

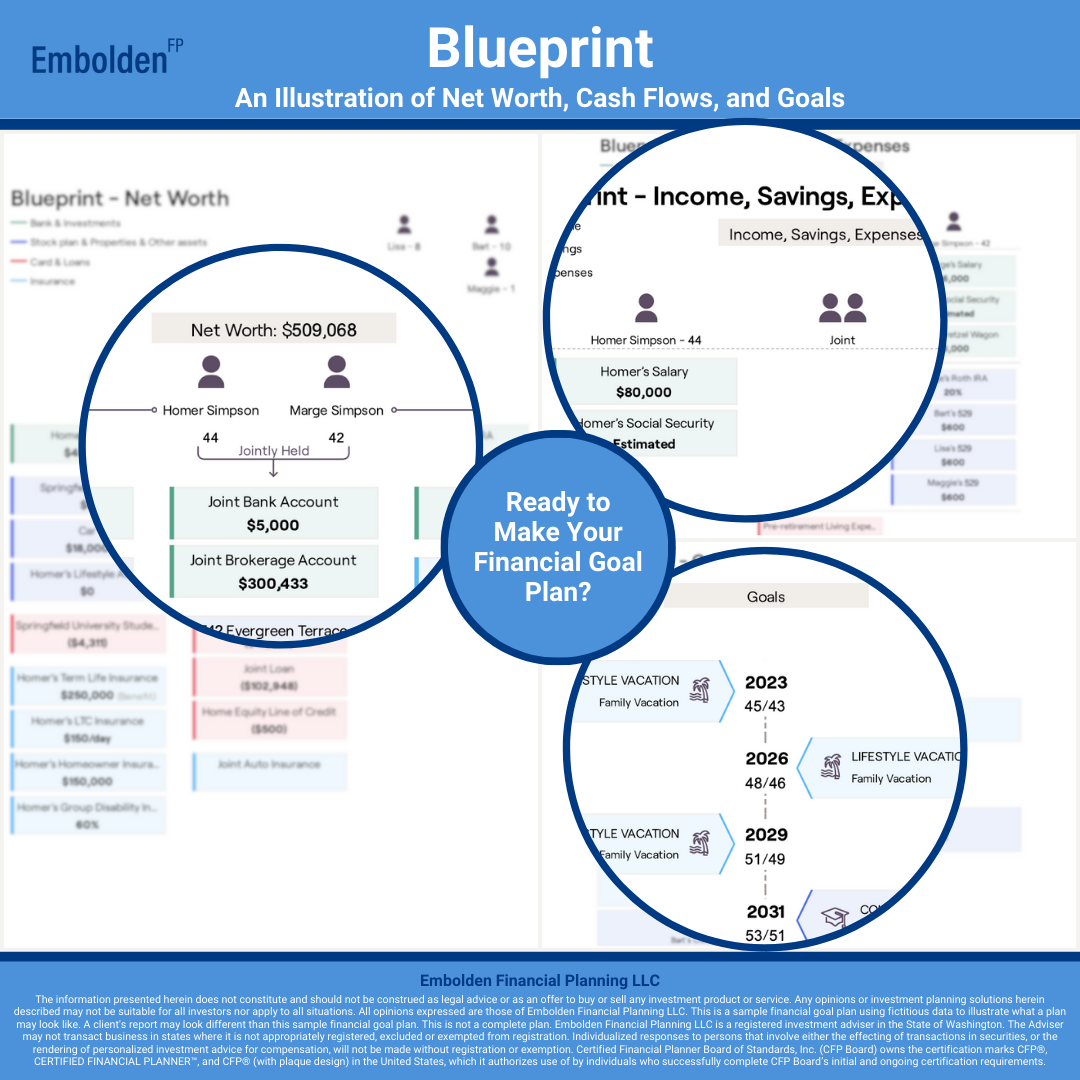

![Blueprint Summary Financial Goal Plan]()

This is the Blueprint for Homer and Marge's financial goal plan.

An illustration of their net worth, income, savings, expenses, and goals.

-

![Blueprint Ready to Make Financial Goal Plan]()

Homer and Marge are now comfortable with their plan for the future.

In addition to this report, they were given detailed instructions on how to implement the plan, including the specific trades needed to bring their portfolio in line with their target allocation. If they have questions, they know Embolden Financial Planning LLC is available to help via email or with a meeting.

-

![Blueprint Ready to Make Financial Goal Plan]()

Homer and Marge are now confident about their plan for the future.

They know that this is just the start of their relationship with Embolden Financial Planning LLC. They are planning to meet annually to make sure they are still on track for success, which will include a review of their portfolio to make sure it is in line with the target asset allocation. If there have been any changes in their lives, like new or different goals, this is a chance to update the financial goal plan.

-

![]()

Comfortable? Confident? Ready to make your financial goal plan?

They also know that Embolden Financial Planning LLC is available to help with any questions or concerns along the way. If a question or concern comes up at any time during the year, Embolden Financial Planning LLC is available to help.

Be Emboldened.

Take the next step and schedule a free, no-obligation,

virtual introductory meeting.